Many financial advisors are vague about fees.

We strive to be different and transparent.

Save time and see our pricing information below!

Most of our revenue comes from

Key Wealth Management

We will always be up front about our fees and always want you to agree we’ve earned them.

Complete Wealth Management

The effective advisory fee percentage is pro-rated and charged quarterly, based on account value. In simple terms, if your account is up 10% in a year, you will experience a 9% net return assuming a 1% fee. Similarly, if your account is down 10% in a year, you will experience an 11% net drop in your account, assuming a 1% fee.

On occasion, these fees are negotiable depending upon the needs of the client and complexity of the situation. The final fee schedule will be detailed in the Client Agreement.

Importantly, the development and ongoing maintenance of your financial plan is included in the schedule above. Unlike many other advisors, we don't charge our wealth management clients separately for this planning service.

For clients that enjoy managing their own investments but value our advice regarding other aspects of their financial life, we could continue the stand-alone planning relationship with an annual retainer, billed monthly.

Lastly, if at any point during the engagement you'd prefer to have us manage your accounts through an advisory relationship (see above), we will consider waiving your outstanding financial planning fees.

Here Are Some Other Common Questions About Our Pricing:

Do you charge a fee for the initial meeting?

No. We offer complimentary meetings and want you to understand the value we can provide before paying us a single penny.

Financial planning can be extremely complex. Just like you would get a second opinion regarding a health issue, we think you should do the same for your investments.

We offer a free consultation if you’re unsure about the services of your current advisor of if you're a DIY investor.

You can schedule your complimentary review here:

Do you have account minimums? Who is your typical client?

There are many variables to consider when choosing a financial advisor. Similarly, there are many variables that we consider when accepting new clients.

Therefore, we do not have an account minimum. Instead, we work with a wide variety of clients in varying financial circumstances that:

- Understand the success of their retirement is too important to manage on their own

- Want a trusted partner to give comprehensive advice for all aspects of their financial life

- Understand the value of their time, and our expertise

Importantly, we will meet with the friends and family of existing clients regardless of their account size or needs. It's an honor to do so and we are always grateful for client referrals.

For additional information, you can see our typical client here:

Will I get a bill each time I call you?

For advisory clients, we are always available to answer your questions and we won’t send you an invoice either!

You are never "on the clock." We are available to answer your questions by phone, email or Zoom and are committed to providing accurate and timely answers to your questions.

Do you ever charge commissions instead of an advisory fee?

Although a much smaller part of our business, there are some scenarios where we will earn a commission instead of an advisory fee. This arrangement would be appropriate under the following circumstances:

- When originating a life insurance or disability insurance policy

- Trading for a non-advisory brokerage account that doesn't require ongoing consultations

- Entering an annuity contract to provide guaranteed income

- Creating an employer-sponsored retirement plan for small-business owners

Some financial advisors market themselves as "fee-only." The unspoken downside of a "fee-only" advisor is that they are forced to refer other professionals for certain aspects of a financial plan and are not licensed to directly provide the non-advisory services referenced above.

At Financial Partners, LLC, we want to be relevant for all your financial planning needs. This means, on occasion, we will earn a commission for providing risk management services and products such as life insurance or the other items mentioned above.

How Do I Open an Account?

It all starts with a conversation. If and when it gets to the point of opening accounts, our fantastic operations team does all the heavy lifting.

We then reach out to you with new account and transfer forms for your review and signature. Most clients opt for electronic delivery via DocuSign but can also send the forms via mail or in person. In a few clicks, we can establish your new accounts and setup secure connections to your bank via ACH for funding them.

How Long Does it Take to Open an Account?

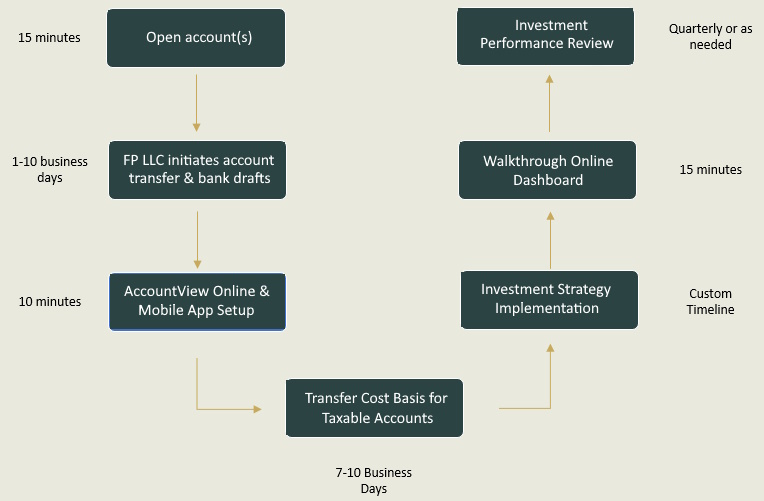

To help you understand the account opening process and timeline, please see the chart below:

Bottom Line

We believe our qualifications and emotional intelligence help us provide our clients with a premium service and experience.

We work with a select group of clients that recognize the value of their time, and our expertise.